Financial technology, commonly known as Fintech, refers to the application of new technology that aims to enhance and automate the delivery and use of financial services. Fintech is primarily utilized to assist businesses, company owners, and consumers in managing their financial operations, processes, and lives more efficiently.

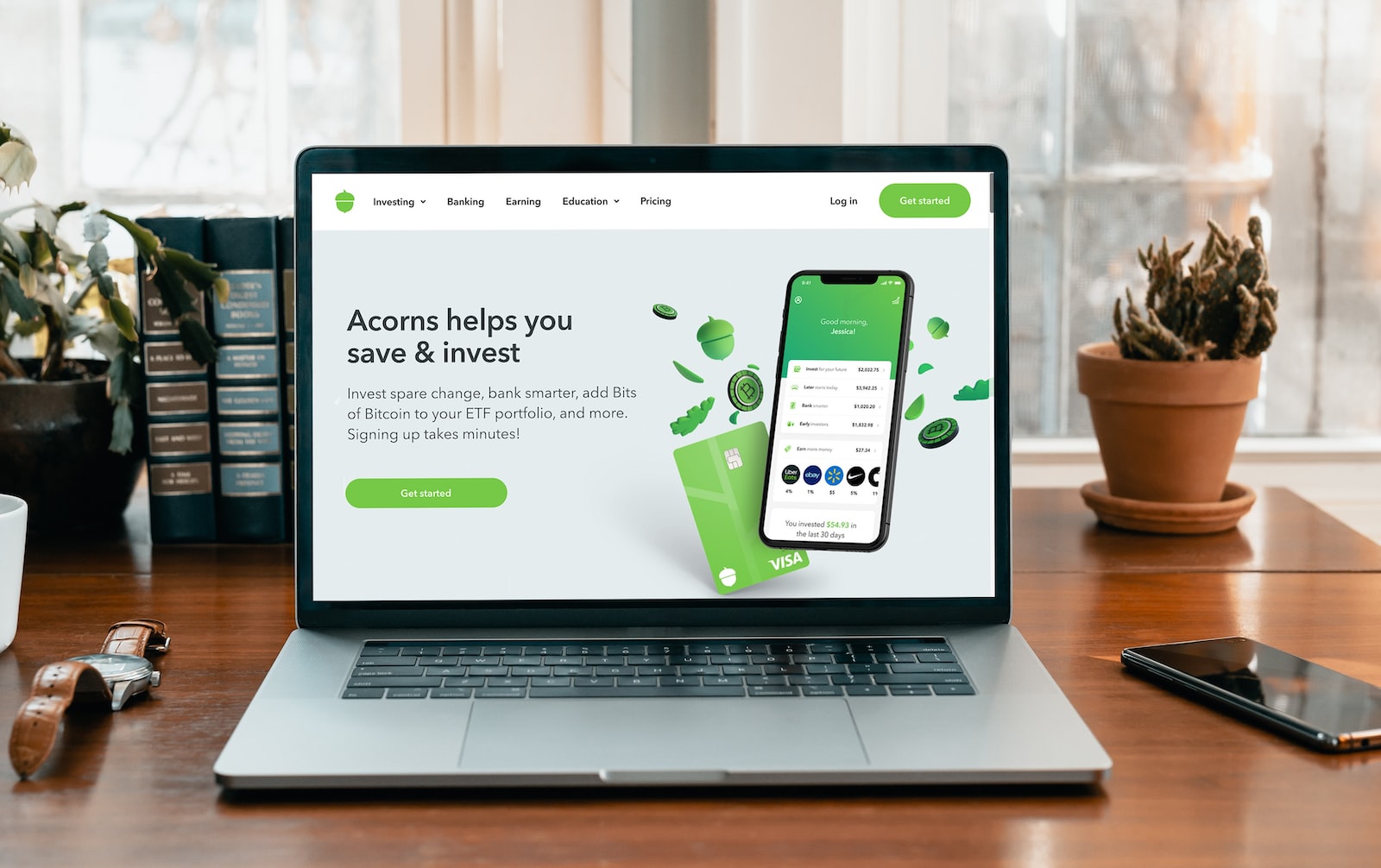

This is achieved by utilizing specialized software and algorithms that are implemented on computers and, increasingly, smartphones. The term “Fintech” is a combination of “financial technology.”

Initially, Fintech referred to the technology used in the back-end systems of established financial institutions. However, there has been a shift towards more consumer-oriented services, resulting in a consumer-oriented definition of Fintech. Today, Fintech encompasses various sectors and industries, including education, retail banking, fundraising and nonprofit, and investment management, among others.

Fintech also encompasses the development and utilization of cryptocurrencies such as Bitcoin. While this segment of Fintech may receive the most attention, the traditional global banking industry still holds the biggest market capitalization.

In general, the term “financial technology” can refer to any innovation in how people transact business, from the invention of digital money to double-entry bookkeeping. With the advent of the internet and mobile internet/smartphone revolution, Fintech has grown exponentially.

It now covers a wide range of financial activities, such as money transfers, depositing checks with smartphones, applying for credit bypassing bank branches, raising money for business startups, or managing investments without the need for a person’s assistance.

Over one-third of consumers use two or more Fintech services, and they are increasingly aware of Fintech’s role in their daily lives.

The most talked-about and funded Fintech startups share a common characteristic: they are designed to pose a threat, challenge, and eventually usurp established traditional financial services providers by offering more nimble, faster, and/or better services or serving an underserved segment of the population.

For instance, one company seeks to cut credit card companies out of the online shopping process by offering a way for consumers to secure immediate, short-term loans for purchases. Similarly, a mortgage company aims to streamline the home mortgage process and eliminate traditional mortgage brokers with a digital-only offering.

It can reward users with a verified pre-approval letter within 24 hours of applying. Another company offers microloans to consumers in the developing world by analyzing their transaction history, mobile games they play, and other seemingly unrelated things.

In summary, Fintech offers solutions to consumers who find some aspects of their financial lives unpleasant or unsuitable. For example, Fintech seeks to address questions like, “Why is what makes up my FICO score so mysterious, and how is it used to judge my creditworthiness?”

Loan originator Upstart aims to make FICO and other traditional and Fintech lenders obsolete by utilizing different data sets to determine creditworthiness, including employment history, education, and credit score knowledge.

Moreover, Fintech offers various financial services, ranging from bridge loans for house flippers to a digital investment platform that addresses women’s unique savings requirements. Women tend to live longer, earn less, and have different salary curves, which can leave less time for savings to grow.